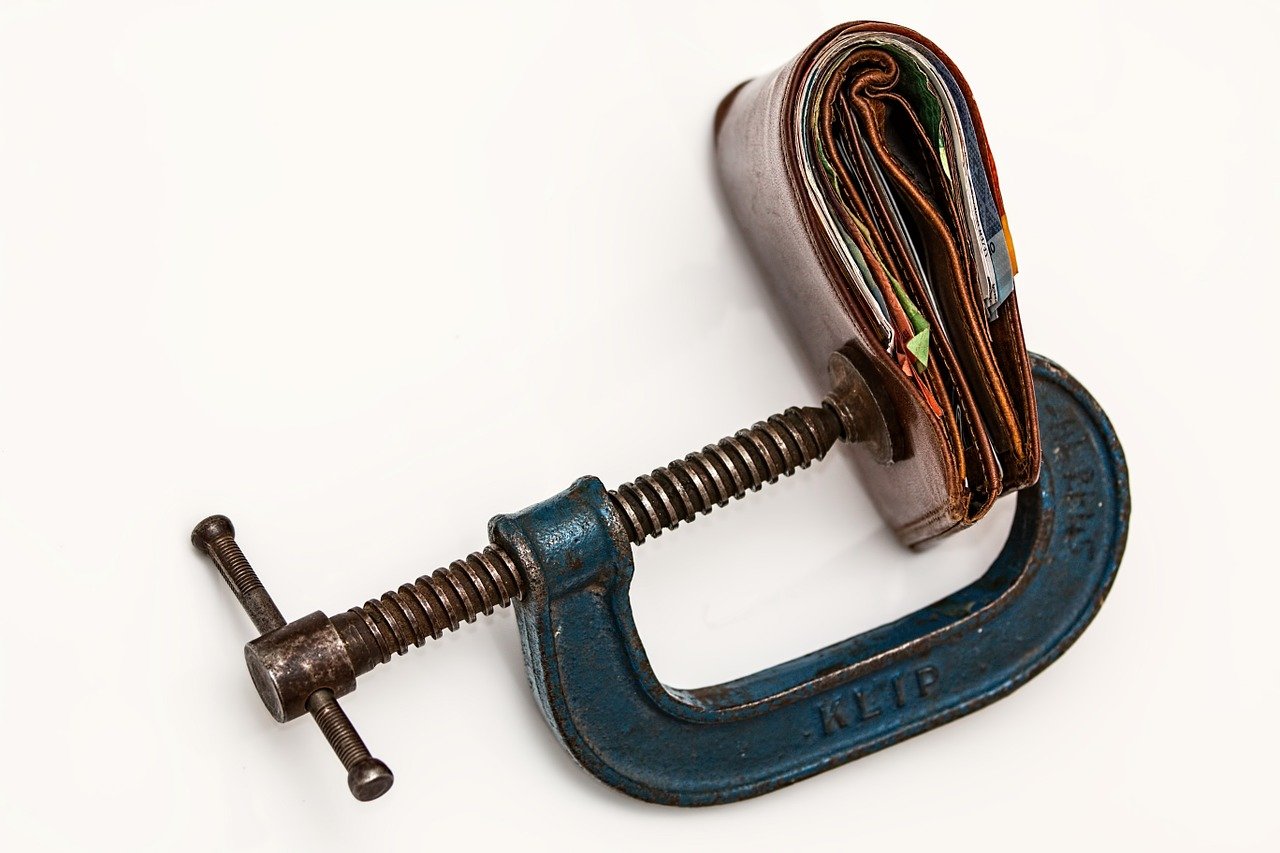

We can define inflation as the increase in the price of goods and services in the economy, during the time of inflation, there is an increase in the price of daily necessities which can be hazardous to society.

Read Also: FINANCIAL INTELLIGENCE

According to the Nigeria Bureau of Statistics, the cost of food inflated to 22.8% in May 2021, what does this mean to an average man, you can’t eat what you want to eat, feeding has become difficult to many, the minimum wage is no longer sufficient.

The impact of inflation makes money saved today become of less value tomorrow, there is an unexpected increase in the price of commodities in the market, most goods and services have increased in the price we can typically say we are in inflation. For instance, if a salary earner takes home 50% and the inflation rate on food alone is 22.8%, he takes home 27.2% if you go further to add his transportation and other bills he might end up in loans.

Inflation in so many ways affect the currency exchange rate, for example, the increase of $1 to 410, there could be a chance of increment in the future, but let’s be positive, there might be deflation.

How to balance inflation with your income

There is no better way to savage inflation like

- Exploring the online opportunities of earning in foreign currency – this is more like saying find a job online, your present job is not enough. For example, you can earn your minimum wage in one gig. Put your skill to good use, sign up on a freelance website.

Read also: How to Become a Copywriter

- Grow your own food, start your farm – it doesn’t have to be a large scale, it’s something you can start in your “back yard” space. One of the basic needs of man is food when money is becoming worthless.

- Spend on the needful – purchase what you and your loved ones need.

- Acquire a skill – skill has proven to become the saving grace to earn a passive income, people will pay you for what they need, this skill(s) must meet and solve the human problem around you. It is extremely imperative you start a side hustle. A skill with high demand will definitely pay off.

- It’s either you adapt or die – It’s either you find a strategic way to survive or you travel out, but for those who cannot travel out it’s imperative, you find a means of survival.

- Make your travel Document ready (japa!) – Plan for the future, find a greener pasture.

- Invest smartly and don’t save.

You might have missed: Accountability – Does Matter?

Pains make you stronger, “what doesn’t kill you makes you stronger.” Humans are wired to survive. In the time of inflation don’t forget to take care of yourself, trust me there is always light at the end of the tunnel. Knowing how to balance inflation with your income is not enough but what you do with it.

Thank you for reading, kindly bear your mind out in our comment section below on the topic how to balance inflation with your income. Please, please and please share with someone.

Helpful.

Perfectly debunked…thank you.